Transport and logistics

Transport and Logistics Potential Development

Joint Stock Company “National Company “Kazakhstan Temir Zholy” (hereinafter - JSC NC KTZh) is a transport and logistics holding company, operator of the main railway network of the Republic of Kazakhstan, national railway freight and passenger carrier. The group of JSC NC KTZh companies provides economic interconnection with 17 regions of the Republic of Kazakhstan and 3 cities of republican significance, and through 16 junction points - with five neighboring countries: China, Russia, Uzbekistan, Kyrgyzstan and Turkmenistan. JSC NC KTZh is the largest owner of locomotives, freight and passenger cars in the country. JSC NC KTZh is one of the largest employers in Kazakhstan.

Key performance results

|

Indicator |

2021 |

2022 |

|

production indicators |

||

|

cargo turnover (operational), billion ton-km |

239 |

252 |

|

passenger turnover, billion pkm |

9.5 |

12.4 |

|

transit in containers, thousand TEU* |

1065.6 |

1129.2 |

|

financial indicators, KZT billion |

||

|

revenue |

1330.2 |

1482.1 |

|

net profit |

119.1 |

34.9 |

|

operating profit |

254.8 |

177.9 |

|

net debt |

1937.4 |

2161.4 |

|

taxes paid |

140.4 |

148.8 |

In the outgoing year, JSC NC KTZh achieved a record, in the entire history of its existence, freight turnover, which exceeded the mark for 252 billion tonnes per kilometer. Over 20 years, this indicator has doubled, by 5.4% to the level of 2021. This achievement was made possible through changes in logistics, increase in the range of transportation and growth of exports of mining and metallurgical products.

The passenger turnover of railway transport also increased by 29.7% as compared to the level of 2021, therefore, the share in the total passenger turnover of the entire transport industry, including civil aviation and road transport, increased by 22% and amounted to 14%.

Factors that Affected Results

Decrease in financial results was due to increase in the costs of materials, fuel and services due to rising prices, financing costs because of growth of debt obligations, payroll fund expenses due to increased salaries to employees of the Company.

Increase in net debt is due to the attraction of debt financing for the renewal of the Company’s locomotive fleet, in the amount of KZT132 billion, and the first issue of bonds was made for the implementation of the infrastructure project “Construction of the Second Tracks of the Dostyk-Moiynty Section”, the KZT162.9 billion.

Growth of greenhouse gas emissions is associated with increase in fuel and energy sector costs. The reason for increase in energy consumption is explained by growth of the volume of freight and passenger traffic by 4.9%.

The volume of disposed waste has been reduced due to the segregation of waste with the subsequent transfer of waste from production and consumption on a reimbursable basis to stakeholders.

In addition, in 2022 there were problems associated with the disruption of traditional transport and logistics chains.

These problems included the following factors:

- the geopolitical situation and logistics changes that resulted in the disruption of the traditional transport chain on the China-Europe-China route;

- difficulties in receiving trains at Kazakhstan-Chinese border crossings;

- inability to accept trains in full at Kazakhstan-Russian and Kazakhstan-Turkmen border crossings;

- sanctions policy towards Iran;

- increased competition from alternative modes of transport.

To ensure the safe and uninterrupted passage of goods through the territory of Kazakhstan, work was carried out on the formation of alternative routes.

A new transit freight flow was attracted along the route from China to Russia and Belarus, as well as in the opposite direction.

The Trans-Caspian International Transport Route (TITR) is a promising direction for the development of international transportation and was actively in demand among shippers for the delivery of goods to the ports of Georgia, Turkey and further to European markets. To expand the TITR capacity, a unified approach to infrastructure development was formed by all participants of the route, a number of projects were planned to improve the infrastructure of the Kazakhstan section of the route, as well as on the territory of Azerbaijan and Georgia.

A lot of work has also been done on the development of the Southern Corridor. Transit traffic along the Southern Corridor, which runs from China through the territory of Kazakhstan and Iran to Turkey, is actively developing.

Infrastructure Modernization

As part of the National Project “Strong Regions is the National Development Driver”, construction of the second tracks on the Dostyk - Moiynty railway section began in November 2022. The aim of the project is to increase the capacity of the site and develop the transit potential of the country.

The construction of the second line with a length of 836 km will increase the capacity of the section by 5 times (from 12 pairs of freight trains to 60 pairs per day). This will solve the important task of ensuring the uninterrupted export of domestic products and will provide the possibility of transporting goods of Kazakhstan exporters in this direction.

The construction is planned to be carried out using domestic materials. At the same time, the share of local content will be over 80%. As part of the project, 3700 builders will be involved, and after the line is put into operation, 500 permanent jobs will be provided on the railway.

The project implementation contributes to the development of small and medium-sized businesses. The cumulative effect of the project implementation will further increase budget revenues in the amount of KZT4.1 trillion over

20 years. The construction is scheduled to be completed in Q4 2025.

In addition, work has been done on a number of projects: construction of the Darbaza–Maktaaral railway line, with the length of 106 km, is scheduled for 2024-2025, construction of the Bakhty-Ayagoz railway line - 3rd border checkpoint with the length of 270 km - is scheduled for 2024-2025, construction of a bypass railway junction around Almaty, with the length of 73 km is scheduled for 2023-2024. Along with major infrastructure initiatives, a plan has been formed to modernize the main railway network and access roads. In the next three years, it is planned to carry out major repairs of more than 2 thousand km of railway tracks.

As part of the development of international transport routes, Kazakhstan has signed joint Roadmaps with Azerbaijan, Turkey and Georgia for 2022-2027 to synchronously eliminate bottlenecks and strengthen the Trans-Caspian International Transport Route. The state plans to increase the capacity of Aktau and Kuryk ports, build a “container hub”, and replenish the merchant fleet with 10 new ferries. It is expected that similar measures will be taken by other signatory countries.

Also in 2022, on behalf of the President, the process of transformation of JSC NC KTZh into the National Transport and Logistics Company started. To date, the Competence Center has been established at JSC NC KTZh, whose main task is to organize new logistics products and reorient transit freight flows to trans-Kazakhstan routes.

Passenger Transportation

The passenger turnover of railway transport also increased by 33.2% as compared to the level of 2021, therefore, the share in the total passenger turnover of the entire transport industry (including civil aviation and road transport) increased by 22% and amounted to 14%.

Passenger Transportation JSC, the KTZh subsidiary, does a lot to create comfortable conditions for passengers. Moreover, given the length of railways on the territory of Kazakhstan, this is a very important factor in maintaining the image attractiveness of this business sector of JSC NC KTZh. The preferences of passengers are studied, feedback is provided, complaints about the service are carefully recorded and sorted out in the company. It does a lot to update the car fleet.

Passenger turnover of Kazakhstan in 2022 by means of transport, million pkm

|

|

Passenger turnover, |

Share in total passenger turnover, % |

||||

|

|

2020 |

2021 |

2022 |

Change 2022/2021, % |

2021 |

2022 |

|

All transport |

108283.6 |

106813.1 |

116516.1 |

9.08 |

100 |

100 |

|

Automobile and urban electric transport |

91298.4 |

79709.3 |

80040.8 |

0.42 |

74.63 |

68.70 |

|

Air transport |

8335.0 |

14815.7 |

20109.3 |

35.73 |

13.87 |

17.26 |

|

Railway transport |

8649.3 |

12286.1 |

16363.0 |

33.18 |

11.50 |

14.04 |

|

Water transport |

0.5 |

1.4 |

2.4 |

71.4 |

0.00 |

0.00 |

|

Sea transport |

0.3 |

0.6 |

0.7 |

16.7 |

0.00 |

0.00 |

The Company passenger turnover in 2022 increased by 29.7% as compared to the level of 2021 and amounted to 12353 million pkm (in 2021 – 9524.3 million pkm). Increase in passenger turnover was due to the lifting of restrictions on the movement of trains associated with coronavirus infection and due to the resumption of interstate and transit trains, as well as the optimization of the route network on Talgo trains with the transfer of individual trains from commercial to social routes.

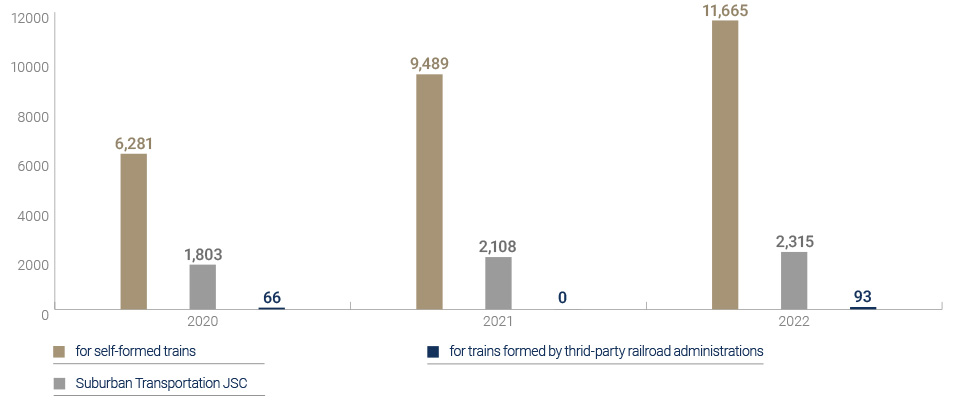

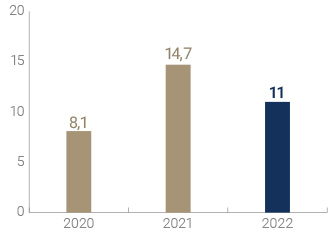

The number of passengers transported by Passenger Transportation JSC in 2022 amounted to 14,073 thousand passengers (in 2021 – 11,597 thousand passengers), including:

- as for trains of the formation of Passenger Transportation JSC – 11,665 thousand passengers;

- as for the branch “Suburban Transportation” – 2,315 thousand passengers;

- as for trains of the formation of third-party railway administrations - 93 thousand passengers.

The number of passengers transported by Passenger Transportation JSC

Income from passenger transportation in 2022 amounted to KZT88.4 billion, which is 54.4% higher than the Actual of the same period in 2021 due to increase in passenger turnover by 29.7%.

New Routes

In January 2022, passenger train No. 77/78, following the route “Mangystau — Almaty-2”, with new compartment and second-class carriages, left Aktau for the first route. This was a big event for Mangistau residents, as the peninsula is located far from both the capital and Almaty.

The Mangystau — Almaty route is the longest in the country, its length is 2,812 kilometers, and, of course, the issue of comfortable travel conditions is top-of-mind for passengers.

The population of the region immediately felt a direct benefit, because the trains of brand-new cars provide incentives for the development of the region’s economy, since the Caspian Sea coast is very attractive for tourism development. And new trains running from here are in great demand not only among local residents, but also among visiting guests and tourists.

By the way, the schedule of these trains has changed: the travel time from Aktau to Almaty has been reduced by 2.5 hours. Passengers will spend this time on the way in new cars with increased service.

The cars have connectors for charging phones (two electrical outlets and two modern USB ports), there is a video surveillance system. For the convenience of passengers, each car has a refrigerator, a microwave oven, a titanium with hot water and a dispenser with drinking water.

The cars were purchased within the framework of the Nurly Zhol infrastructur development state program and assembled at the Tulpar plant according to the technology of the Tver Car Building Plant. Industrial Development Fund JSC funded the purchase of cars.

A railway operation between Atyrau and Astrakhan has also been opened. Trips are carried out by international passenger train No. 625/626 with the Atyrau-Astrakhan traffic. The decision to launch was taken based on a bilateral agreement between the railway administrations of Kazakhstan and Russia. The frequency of running is every other day.

In September 2022, JSC NC KTZh, meeting customer requests, launched the Astana–Zhezkazgan train, running every other day.

There are 344 seats in the train formed from Talgo cars. The cars are equipped with air conditioning and toilets. There are sockets in each compartment, and on the way they can watch movies and listen to music on the Vputi.kz multimedia portal.

In addition, passengers can use the services of a dining car. Shower cabins are provided in the Grand and Grand PMR class cars (for persons with disabilities).

Passenger Transportation JSC is constantly updating its car fleet. Only in the period from 2010 to 2022, the company purchased 1,224 cars, of which 141 cars were used to upgrade train fleet in Mangystau region.

A pleasant news for the fair sex was the appearance of a special female car on the Mangistau — Almaty-2 route. In 2021, the company conducted a market analysis and a customer survey, as a result of which Passenger Transportation decided to introduce a new service for female passengers. Externally and internally, women’s cars are no different from others. Only when booking train tickets on the BILET.RAILWAYS.KZ website or at the ticket offices of Passenger Transportation JSC, if there is a “female” sign, this car will be intended only for the sale of tickets to exclusively female passengers. As part of the pilot project, the service was decided to be implemented on the longest Mangystau — Almaty and Almaty — Ust-Kamenogorsk routes.

As part of the pilot implementation of the loyalty program, from March 14, 2022, Passenger Transportation JSC launched the Altyn discount card. It provides a 25% discount on trips in standard passenger cars and Talgo. The card can be purchased at the company’s ticket offices, its cost in 2022 amounted to KZT19,999. You can use the discount card for offline and online ticket purchases.

Comfortable Conditions for Passengers

In 2022, 62 Talgo railcars were added to the passenger railway fleet of Kazakhstan. According to results of the international competition, it is planned to purchase about 500 more new cars in the coming years. All of them will comply with international standards. After the delivery of these cars, the fleet will be updated by a total of two-thirds. At the end of 2022, according to the results of an international competition, based on the recommendations of DB Engineering & Consulting, the Swiss company Stadler Bussnang AG was identified as a partner in a project for the production of passenger cars in Kazakhstan on the basis of the Tulpar plant.

Stadler cars have a number of advantages: the service life is 40 years, the European quality standard, modern design, localization level of at least 35% and the transfer of the latest technologies.

Among the advantages is also the capacity of the fuel tank of the cars, which will permit the passenger train to operate in autonomous mode much longer compared to other manufacturers.

In general, the technical characteristics of the cars permit for uncoupling repairs, without lengthy uncoupling for scheduled repairs. Thus, the trains will ensure a continuous transportation process.

It is planned that to organize the production of cars, the local staff of Tulpar will undergo appropriate training at the Stadler plants. To date, JSC NC KTZh is working on the issue of financing with the participation of Samruk-Kazyna JSC, negotiations are also underway to minimize currency risks.

Сargo transportation

Increase in the volume of freight turnover was observed in inland waterway transport – 54.5%, sea transport – by 23.4%. Increase in the turnover of pipeline transport amounted to 3.6%.

In 2022, the tariff turnover of JSC NC KTZh amounted to 245.2 billion tonnes per kilometer, which is 5.1% higher than the level of 2021. Growth is due to increase in freight turnover in export and transit traffic. The total operational freight turnover has reached a historical maximum and amounted to 252 billion tonnes per kilometer – and this is an absolute record of the railway workers of Kazakhstan.

It is noteworthy that freight transportation within the country, on the contrary, demonstrated decrease of 1.9%. This happened due to decrease in the volume of transportation of ferrous scrap, iron ore and non-ferrous metal ore, grain.

But for export, freight turnover increased by 10.3%. Freight turnover decreased by 2.3% on import to Kazakhstan (due to decrease in the volume of freight transportation by 3%). The volume of transportation of petroleum products, coal, chemicals, construction goods, ferrous scrap, fertilizers, non-ferrous metals, coal coke, cement has decreased.

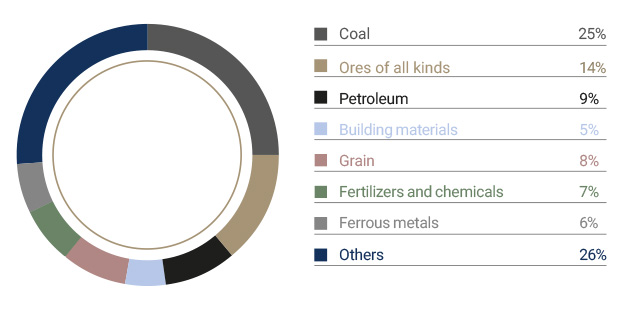

The share of main cargo in the freight turnover of JSC NC Kazakhstan Temir Zholy for 2022 as a percentage

Freight trains transiting through Kazakhstan resulted in 14% increase. Which is not surprising, given growth in the volume of traffic as a whole - by 10.5%. Coal shipments from Kyrgyzstan to Belarus, Russia and European countries have increased; iron ore from Russia to Uzbekistan and China; petroleum products from Russia and Belarus to Central Asian countries, etc.

In 2022, there was increase in freight turnover in relation to 2021:

- coal – by 3.5%;

- oil products – by 11.7%;

- grain – by 9.4%;

- non–ferrous metals - by 20.5%.

In 2021, the railway administration of Kazakhstan took measures to overcome pandemic restrictions. And this permitted us to maintain positive dynamics in 2022. Transit freight transportation increased by more than 10%, including in containers – by 6%.

The main factors of increase in transit traffic were a new freight flow of coal from Kyrgyzstan to Russia, Belarus and European countries; significant increase in petroleum products from Russia and Belarus to the Central Asian countries and Afghanistan due to decline in exchange prices in Russia; increase in grain transportation from Russia to Kyrgyzstan; change in the logistics of chemical freight transportation – growth in the supply of polyvinyl chloride and caustic from China to Russia and Central Asian countries.

Logistics, which changed due to geopolitical reasons, resulted in the fact that in the absence of transportation of fertilizers (carbamide, potassium chloride, ammonium nitrate) from Uzbekistan to Ukraine, producers from this country reoriented to partners from Latvia, Poland, Belarus and other European countries. Transportation of potash fertilizers in containers from Belarus to China has increased. Growth of container traffic on the China-Russia-China route has sharply increased.

Alternative Transportation Routes

In August 2022, the President of Kazakhstan gave instructions on the Trans-Caspian International Transport Route (TITR). Today, this promising area of international transportation development is actively in demand among shippers for the delivery of goods to the ports of Georgia, Turkey and further to European markets.

The eastern direction of the North-South international transport corridor is also considered by shippers as an alternative route for transporting their products to the markets of Iran, India and the Persian Gulf countries.

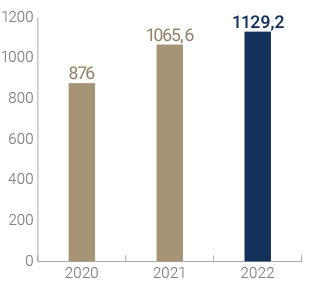

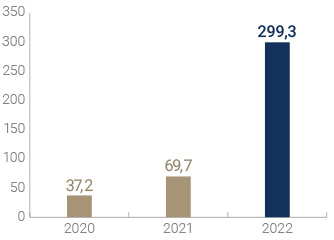

Transit in containers increased by 6% to the level of 2021 and amounted to 1,129.2 thous. TEU7.

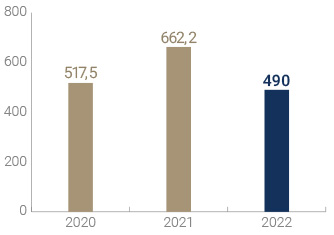

В то же время, по итогам 2022 года контейнерные перевозки в направлении «Китай - Европа - Китай» снизились на 26 % к 2022 году и составили 490 тыс. ДФЭ.

Transit in containersfrom 2020 to 2022, thousand TEU

Transit in containers in the period from 2020 to 2022, thous. TEU

China-EU-China

China-CA-China

PRC-RF-PRC

TITR

In addition, active work is being carried out to increase transit freight traffic through the Trans–Caspian International Transport Route and the North-South Corridor in the direction of India and the Persian Gulf countries through Iran and the Iranian port of Bandar Abbas.

A container service and, in particular, a shuttle train on the Altynkol-Aktau-Baku-Poti/Batumi TITR route has been organized and launched.

A roadmap has been developed for the project “Construction of the Ayagoz-Bakhty Railway Line”, within the framework of which JSC NC KTZh together with Russian Railways JSC has begun to analyze the existing and potential (in conditions of increasing) volumes of freight transportation in the Russia-Kazakhstan-China traffic until 2030.

Plans for 2023

- In 2023, JSC NC KTZh plans to implement the following goals:

- increase the operational freight turnover to 268.8 billion tkm (6.7% by 2022);

- increase container transit to 1,250 thous. TEU (10.7% by 2022);

- continue work on the renewal of the park and modernization of infrastructure;

- continue the construction of the second tracks of the Dostyk–Moiynty railway section;

- start the construction of two railway lines (bypassing Almaty station, Bakhty-Ayagoz)

- start implementing trade hub projects;

- create a joint venture with PSA to manage TITR assets;

- start the production of passenger cars built using Stadler technology;

- continue the transformation of the Company into a national transport and logistics company.