Board of Directors and its Committees

The leading role of the Board of Directors

The Board of Directors of the Fund is a governing body accountable to the Sole Shareholder, providing strategic guidance and control over the activities of the Management Board of the Fund. The Board of Directors ensures the implementation of all provisions of the Corporate Governance Code of the Fund.

The performance of the Board of Directors is based on the principles of efficiency and responsibility, maximum alignment and implementation of the interests of the Sole Shareholder and the Fund, as well as protection of rights of the Sole Shareholder and responsibility for the operations of the Fund.

The Board of Directors is self-sustaining and independent in taking decisions and performing any actions within its competence in accordance with the Law on the Fund, the Code and the Charter.

The Board of Directors is not entitled to take decisions on issues that, in accordance with the legislative acts of the Republic of Kazakhstan and the Charter, are referred to the exclusive competence of the Sole Shareholder (unless otherwise provided by the legislative acts of the Republic of Kazakhstan) and the Executive Body of the Fund, as well as take decisions that contradict decisions of the Sole Shareholder.

During 2022, the Board of Directors did not have any contradictions with these requirements.

The Board of Directors has sufficient authorities to manage the organization and control over the activities of the Management Board. The board of directors carries out its functions under the charter and pays special attention to the following:

- Determining the development plan and integrating the ESG goals;

- Setting and monitoring the key performance indicators as part of the action plan;

- Organising and controlling the effectiveness of risk management and internal control systems;

- Approving and monitoring the effective execution of major investments and other key strategic projects within the competence of the Board of Directors;

- election of members of the Management Board (except for the Chief Executive Officer), remuneration, succession planning and supervision of the activities of the CEO and members of the Management Board;

- Meeting the provisions of the Corporate Governance Code and corporate standards of the Fund.

A complete list of issues referred to the exclusive competence of the Board of Directors is determined by the Law of the Republic of Kazakhstan “On Sovereign Wealth Fund” and is disclosed in the Charter of the Fund at http://www.sk.kz

The members of the Board of Directors properly perform their duties and ensure growth of the long-term value and sustainable development of the organization.

When performing their duties, members of the Board of Directors comply with the following principles:

- Act within their competence - members of the Board of Directors make decisions and act within their powers specified in the Charter;

- Commit sufficient time for taking part in meetings of the Board of Directors, its Committees and preparing for the meetings - a member of the Board of Directors may not hold simultaneous membership of more than four legal entities or simultaneous Chairmanship in more than two Boards of Directors;

- Promote the Organisation’s growth in long-term value and Sustainable Development - members of the Board of Directors act in the interests of the Organisation, treat all Shareholders fairly and follow the principles of Sustainable Development. The influence of decisions and actions of the Board of Directors members may be assessed through the following questions: what are the long-term consequences of the decision/action? What are the social and environmental impacts of the Organisation’s activities? Will all Shareholders be treated fairly? What is the impact on the Organisation’s reputation and high ethical standards? What is the impact on Stakeholders’ interests? (While essential, this list of questions is not exhaustive);

- Maintain high standards of business ethics - in their actions, decisions and behaviour, members of the Board of Directors comply with high standards of business ethics and act as role models for employees of the Fund and the Organisation;

- Avoid conflicts of interest - a member of the Board of Directors prevents situations in which their personal interest may affect the proper performance of their duties as members of the Board of Directors. If a conflict of interest affects or may potentially affect impartial decision-making, the members of the Board of Directors give advance notice to the Chairman of the Board of Directors and should not take part in the respective decision-making. This requirement also applies to the Board of Directors member’s other actions that affect directly or indirectly the proper performance of their duties;

- Act reasonably, skilfully and with due diligence - members of the Board of Directors are recommended to develop their knowledge in terms of the Board of directors competence regularly and performing their duties in the Board of Directors and Committees. This may include such areas as law, corporate governance, risk management, finance and audit, Sustainable Development, industry knowledge and features of the Organisation’s business. To understand issues related to the Organisation’s business, members of the Board of Directors regularly visit key sites and meet employees of the Organisation.

- Al-Farabi Kazakh State National University - Applied Mathematics;

- Kazakhstan Institute of Management, Economics and Forecasting under the President of the Republic of Kazakhstan - Master of Public Administration.

In the period from 1993 to 1999, Alikhan Askhanovich worked as the Chief Specialist in A-Invest Investment and Privatization Fund; Deputy Head of the Department, Head of the Department of the National Statistical Agency of the Republic of Kazakhstan; Deputy Chairman of the Statistics and Analysis Committee of the Agency for Statistical Planning and Reforms of the Republic of Kazakhstan; Chief Expert, Head of the Economic Sector of the Department, State Inspector of the Executive Office of the President of the Republic of Kazakhstan.

In 1999-2003, he served as the Chairman of the Statistics Agency of the Republic of Kazakhstan. In 2003-2006, he took the position of the Vice-Minister of Foreign Affairs of the Republic of Kazakhstan, Chief Executive Officer of State Insurance Company for Export Credits and Investments Insurance JSC. In 2006-2009, he was the Vice-Minister of Finance of the Republic of Kazakhstan, President of JSC NMH KazAgro. In 2009-2014, he hold the position of the Chairman of the Statistics Agency of the Republic of Kazakhstan. In 2014-2015, he served as the Chairman of the Statistics Committee of the Ministry of National Economy of the Republic of Kazakhstan. In 2015-2018, he worked as the Aide to the President of the Republic of Kazakhstan. From September 2018 to February 2019, he fulfilled the duties of the Minister of Finance. On February 25, 2019, the President of the Republic of Kazakhstan by the Decree was appointed him the First Deputy Prime Minister - Minister of Finance. On January 18, 2021, the President of the Republic of Kazakhstan by the Decree reassigned him to this position. On January 11, 2022, the President of the Republic of Kazakhstan by the Decree appointed him to the post of Prime Minister of the Republic of Kazakhstan. On March 30, 2023, the President of the Republic of Kazakhstan by the Decree reassigned him to the post of Prime Minister of the Republic of Kazakhstan.

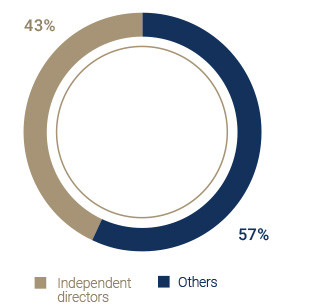

Share of Independent Directors on the Board of Directors in the Fund group

Gender diversity of members of the Board of Directors in the Fund group

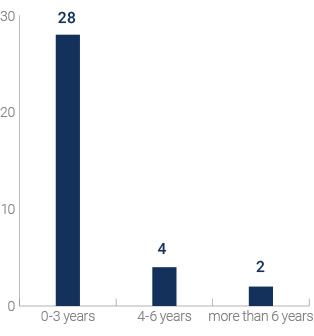

Tenure of independent directors on the Board of Directors in the Fund group

- S. Toraighyrov Pavlodar State University – Economics and Management in the Social sphere;

- S. Toraighyrov Pavlodar State University – Jurisprudence;

- University of Maryland (USA) – Master of Business Administration in the Bolashak program, Master of Business with a specialization in Finance.

Timur Muratovich started working in 1999-2000 as the Economist Manager of family outpatient clinic No. 3 in Pavlodar. In 2002-2006 he worked as the Consultant, Chief Consultant of Ernst & Young Kazakhstan in Almaty. From 2006 to 2009, he served as the Director of the Tax Accounting and Tax Planning Department of KazMunayGas Exploration and Production JSC. From 2009 to 2010, he took the position of the Vice-Minister of Economy and Budget Planning of the Republic of Kazakhstan. From 2010 to 2012, he hold the post of the Vice-Minister of Economic Development and Trade of the Republic of Kazakhstan. From 2012 to 2016, he was a member of the Board of the Eurasian Economic Commission (Minister) for Economy and Financial Policy. In 2016-2019, he worked as the Minister of National Economy of the Republic of Kazakhstan. In 2017-2019, he was the member of the Board of Directors of JSC NMH KazAgro. Since April 2019, he took the position of the member of the Board of Directors of JSC NMH Baiterek. From February to March 2019, he worked as Deputy Chief Executive Officer of the National Bank of the Republic of Kazakhstan. From March to July 2019, he took the position of the Assistant to the President of the Republic of Kazakhstan. From July 2019 to January 2022, he worked as a Deputy Chief of Staff of the President of the Republic of Kazakhstan. On January 13, 2022, by the Decree of the Head of State, he was appointed First Deputy Chief of Staff of the President of the Republic of Kazakhstan.

- Tomsk State University - “Finance and Credit” and “Linguistics and Intercultural Communication”;

- University of Michigan – Master of Applied Economics in the Bolashak program.

He started his career in 2005 as the Leading Specialist of the Internal Administration Department, the International Relations Department of the Ministry of Economy and Budget Planning of the Republic of Kazakhstan. In 2006-2010 he worked as the Expert, Chief Expert of the Investment Policy and Planning Department of the Ministry of Economy and Budget Planning and the Ministry of Economic Development and Trade of the Republic of Kazakhstan. In November 2010, he was the Head of the Strategic Development Department of the Strategic Planning and Analysis Department of the Ministry of Economic Development and Trade of the Republic of Kazakhstan. From 2010 to 2013, he occupied the position of Deputy Director of the Budget Policy and Planning Department and the Budget Planning and Forecasting Department of the Ministry of Finance of the Republic of Kazakhstan. From February to June 2013, he worked as the Deputy Chairman of the Geology and Subsoil Use Committee of the Ministry of Industry and New Technologies of the Republic of Kazakhstan. In 2013-2019, he took the position of the Deputy Head of the Center for Strategic Research and Analysis, Deputy Head of the Social Economic Monitoring Department of the Executive Office of the President of the Republic of Kazakhstan. In 2019-2021, he fulfilled the duties of the Deputy Head of the Chancellery of the First President – Yelbasy of the Republic of Kazakhstan. In 2021-2022, he worked as the Vice Minister of National Economy of the Republic of Kazakhstan. The Head of State by the Decree dated January 11, 2022, appointed him the Minister of National Economy of the Republic of Kazakhstan. On April 04, 2023, the Head of State by the Decree reassigned him to the position of the Minister of National Economy of the Republic of Kazakhstan.

- Candidate of Economic Sciences.

In different years he held the positions of Vice-Minister of Labor and Social Protection of the Population of the Republic of Kazakhstan (November 1997 - March 1999), Vice-Minister of Finance of the Republic of Kazakhstan (March 1999 - June 2001), Vice-Minister of Internal Affairs of the Republic of Kazakhstan (June 2001 - February 2002), Vice-Minister of Finance of the Republic of Kazakhstan (February 07, 2002 - February 2003), Deputy Chairman of the National Bank (February 2003 - January 2004), Chairman of the Agency of the Republic of Kazakhstan for Regulation and Supervision of the Financial Market and Financial Organizations (January 2004 - January 2006), Deputy CEO of Eurasian Development Bank (EDB) (June 2006 - November 2007), Minister of Finance of the Republic of Kazakhstan (November 2007 - November 2013), Minister of Regional Development of the Republic of Kazakhstan (November 2013 - August 2014), CEO of Development Bank of Kazakhstan JSC (August 2014 - April 2019), Chairman of the Board of Directors of Social Health Insurance Fund NJSC (from April 2020 - August 2022).

On October 30, 2020, he was appointed Chairman of the Board of Directors of Bank RBK JSC.

On January 15, 2022, he was elected CEO of Kazakhstan Khalkyna Public Fund.

On February 17, 2022, he was elected Chairman of the Samruk-Kazyna JSC Public Council.

- Bocconi University (Italy) – Master’s degree in Business Economics

- IE Business School International School (Spain) - MBA Program for top executives of Global Executive MBA

- Chartered Accountant (CPA)

- Certified Director (CIoD)

Mr Sutera is an experienced finance and investment executive with 25 years of post-graduate experience, of which 17 years serving as CFO for global energy companies and Sovereign Wealth Funds in Europe, Russia and the Middle East. Mr Sutera is currently Operating Partner of Asterion Industrial Partners, a leading European Investment Management Firm focused on European Infrastructure and Group Chief Financial Officer of Energy Asset Group, a leading UK-based integrated utility company. Prior to joining Energy Asset Group, from 2015 to 2020, Mr Sutera served as Chief Financial Officer of the Nebras Power Group, a Qatar-based state-owned global energy company. From 2011 to 2015 Mr. Sutera served as Chief Financial Officer of the global Power & Water Business of TAQA, Abu Dhabi-based state-owned global energy company.

- University of the Witwatersrand (South Africa) - Bachelor of Science (Mining Engineering);

- University of the Witwatersrand (South Africa) - Master of Science (Mineral Economics);

- Heriot-Watt University (UK) – MBA.

Mr Dudas began his working career at Rand Mines Ltd in 1984 and has held a variety of senior managerial and executive positions across a number of commodities and functions at companies including BHP, where he was CEO of the global Aluminum division. Since 2012, Mr Dudas has been working as an independent corporate adviser to multinational mining and professional service companies. From November 2015 to December 2019, was a member of the Board of Directors of JSC NAC Kazatomprom and elected Chairman of the Board of Directors in 2018,

By the decision of the Sole Shareholder dated December 6, 2019 (Decree of the Government of the Republic of Kazakhstan No.907), he was elected to the composition of the Board of Directors of Samruk-Kazyna JSC as an independent director.

The Board of Directors by decision dated February 06, 2020, No.167 appointed him to the position of the Chairman of the Board of Directors of the Fund.

Due to the election of the Prime Minister of the Republic of Kazakhstan to the post of the Chairman of the Board of Directors of the Fund, according to the decision of the Sole Shareholder dated January 16, 2023 (Decree of the Government of the Republic of Kazakhstan No. 19), he was elected the Member of the Board of Directors of the Fund as an Independent Director.

- Moscow State Institute of International Relations of the Ministry of Foreign Affairs of the Russian Federation, Faculty of International Economic Relations (1996-2001) - Bachelor of Economics, Master of Economics, Candidate of Economic Sciences

In 2001-2003, Nurlan Karshagovich worked as the Financia Analyst at the Eurasian Industrial Association (ENRC) In 2003-2004, he hold the position of the Business Manager at Chambishi Metals PLC (Zambia, Kitwe) and 2004 - 2007 - the Project Manager at Research, Investment and Development Ltd. In 2007-2009, he worked as the Analyst for the value of the company’s shares traded on the stock exchange, the Credit Suisse basic materials team. In 2009-2011, he worked as the Managing Director, Member of the Management Board of JSC “National Mining Company “Tau-Ken Samruk”. In 2011-2012, he became the Director of the Investment Banking Department, the Head of the Representative Office in Astana of JSC “Subsidiary Bank “RBS (Kazakhstan)”. In 2012-2016, he took the position of the Executive Director of the Investment Banking Department, Head of the Representative Office in Astana of UBS AG Almaty Representative Office. In 2016-2017, he was the Managing Director for Development and Investment - Member of the Management Board of JSC “NAC “Kazatomprom”. In 2017-2019, he served as the CEO of JSC SEC Astana. In 2019-2020, he was the Representative in Kazakhstan of Rothschild & Co. From 2020 to April 2023, he worked as CEO of Kazakhstan Investment Development Fund (KIDF) Management Company Ltd.

Changes in the composition of the Board of Directors of the Fund for 2022-2023

|

Date |

Member of the Board of Directors |

Event |

|

January 28, 2022 |

Kanat Bozumbayev |

Early termination of powers of a member of the Board of Directors |

|

January 28, 2022 |

Vyacheslav Kim |

Early termination of powers of a member of the Board of Directors |

|

January 28, 2022 |

Daniyar Akishev |

Early termination of powers of a member of the Board of Directors |

|

February 19, 2022 |

Ong Boon Hwee |

Early termination of powers of a member of the Board of Directors |

|

July 01, 2022 |

Bolat Zhamishev |

Elected a member of the Board of Directors as the Independent Director |

|

January 16, 2023 |

Alikhan Smailov |

Elected Chairman of the Board of Directors |

|

April 04, 2023 |

Almassadam Satkaliyev |

Early termination of powers of a member of the Board of Directors |

|

April 04, 2023 |

Nurlan Zhakupov |

Elected the member of the Board of Directors |

|

May 01, 2023 |

Jon Dudas |

Early termination of powers of a member of the Board of Directors |

Work of the Board of Directors in 2022

In the reporting period, the Board of Directors Fund was focused on solving tasks within its competence through the prism of strategic goals. The list of issues and decisions are reflected in the corresponding Minutes and decisions of the Board of Directors meetings. The meetings of the Board of Directors were held in accordance with the Work Plan of the Board of Directors of the Fund. Meetings of the Board of Directors and its Committees were held by means of in-presence or absentee voting.

As part of measures taken by the Board of Directors to increase the long-term value and sustainable development of the organization, 18 meetings of the Board of Directors of the Fund were held in 2022, of which 12 in-presence meetings and 8 absentee meetings. In total, 121 issues were considered, on which 208 instructions were given.

Based on results of the comparative analysis of the activities of the Board of Directors of the Fund for the period 2018 - 2022, there is increase in the number of issues considered in 2022, as well as decrease in the number of absentee meetings, which meets the best global corporate governance practices.

|

Indicator |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Number of meetings |

11 (8 in-presence/ 3 absentee) |

10 (6 in-presence/ 4 absentee) |

15 (5 in-presence/ 10 absentee) |

10 (8 in-presence/ 2 absentee) |

18 (12 in-presence/ 6 absentee) |

|

Number of issues |

111 |

88 |

1w01 |

116 |

121 |

Issues considered by the Board of Directors in 2022, by categories:

|

Strategic issues |

|

|

Issues in economy and finance |

|

|

Reports |

|

|

Issues of subsidiaries and affiliates of the Fund |

|

|

Corporate governance issues |

|

|

Approval/updating of internal regulatory documents |

|

Strengthening Corporate Governance for the Fund Group

Strengthening corporate governance is one of the fundamental aspects to increase the long-term value of the companies. For all PCs, regardless of the plans and timing of the IPO, the goal is to significantly improve corporate governance practices to the level of listing requirements of leading international exchanges in terms of compliance, disclosure, decision-making transparency, procurement and other aspects of corporate governance.

Implementation of the best international practices of corporate governance will increase the level of perception of the company by shareholders and investors, reduce the cost of borrowed capital, and ultimately will increase the long-term value of the company.

In 2022, the Fund has taken systematic measures to ensure the effectiveness of the Board of Directors in Portfolio Companies and further improve corporate governance by:

- maximum approximation of standards to the requirements of leading listed exchanges, OECD regulations, recommendations of the Financial Conduct Authority, Institute of Directors. In all PCs, the Charters and Regulations on the Board of Directors have been updated in terms of delineating the competencies and powers of the Board of Directors and the Management Board, the procedure for holding meetings and the format of materials for meetings of the Board of Directors have been unified;

- strengthening the role of the Board of Directors of Portfolio Companies and ensuring the adoption of independent, objective decisions of the Board of Directors by attracting highly professional independent directors. The selection criteria for members of the Board of Directors have been increased, in terms of independence and compliance with the balance of skills, experience, elements of diversity and inclusiveness, sectorial specifics (relevant requirements have been introduced in the Code, the share of Independent Directors on the Board of Directors for the Fund group has been increased to 43%, the share of women in the Fund group – up to 15%);

- de-bureaucratization of processes, elimination of unnecessary links, creation of additional mechanisms to increase efficiency, optimize and speed up the implementation of business processes of interaction between the Fund and Portfolio Companies when reviewing and approving documents. Amendments and additions have been made to the Manual on Engagement with Portfolio Companies;

- qualitative disclosure of information. The approaches to the formation of the annual report and the Sustainability Report have been revised, a self-assessment report of the Fund on compliance with the Principles of Santiago was prepared, sent to the International Group of Sovereign Wealth Fund Managers (IFSWF);

- Introduction of ESG principles. The Code has been updated regarding the implementation of ESG principles. Integrated EGS Implementation Plans have been approved in Portfolio Companies. KAP, KMG and KTZh have received ESG ratings, preparatory work is underway in other Portfolio Companies.

Increasing the Role of the Board of Directors. Independence of Directors and Conflict of Interests

The structure of the Board of Directors composition will be formed given the requirements to the formation of the full-fledged and effective committees that are key working bodies of the Board of Directors. The Fund will support the work with the succession of the composition of the PC Board of Directors. For this purpose, high-quality work will be ensured to maintain the Fund’s talent pool for potential members of the PC Board of Directors, as well as to select and hire directors who meet the target profile.

The role of the Board of Directors in the Fund governance is increasing on an ongoing basis, with a focus on the opinion of independent directors. The Fund will strive to maintain the share of independent directors in the PCs at the level of 50%.

The Boards of Directors of the Fund group include Independent Directors. The number of Independent Directors should provide for independence in decision-making and fair treatment of all stakeholders.

An Independent Director is a person that has sufficient expertise and autonomy to make independent and objective decisions, and be free from the influence of any Shareholder, the Executive Body and other Stakeholders.

The criteria for Director independence are specified in legislation of the Republic of Kazakhstan and the Organisation’s Charter.

In addition to the requirements established by the legislation of the Republic of Kazakhstan, in 2022 the Fund strengthened the criteria for independence in compliance with instructions of the UK Corporate Governance Code:

- whether he/she is or has been an employee of the company or group for the past three years;

- whether he/she has or has had for the last three years a material business relationship with the company directly or as a partner, shareholder, director or general manager of the body maintaining such a relationship with the company;

- whether he/she has received or is receiving additional remuneration from the company in addition to the director’s remuneration, participates in an option on the company’s shares or in a performance-based payment scheme, or is a participant in the company’s pension scheme;

- whether he/she has membership in the Board of Directors or has connections with other directors through participation in other companies or bodies;

- whether he/she represents a major shareholder;

- whether he/she has served on the Board of Directors for more than nine years since first appointment.

The Independent Director monitors its independence and notifies the Chairman of the Board of Directors as soon as they detect a potential loss of independence.

During 2022, the Fund continued to work to ensure compliance with the independence status of the directors of the Fund group.

Risk management issues considered by the Board of Directors

In compliance with the current Risk Management and Internal Control Policy, the Board of Directors plays an important role in forming the appropriate leadership culture to support and develop a risk management system, as well as in implementing mechanisms to ensure that this leadership culture is reflected throughout the Fund group. The Board of Directors takes an active part in discussing issues within the framework of the risk management, internal control and audit system, provides recommendations on the effectiveness and improvement of relevant business processes.

The Board of Directors has defined the principle of “three lines of defense” in order to effectively manage risks. The first line of defense is the direct owners of business processes, who play a key role in minimizing risks. The second line of defense is the control functions, including the Risk Management and Internal Control Department, Compliance Service, Security Service, responsible for the overall organization of the risk management system and providing methodological support for the first line of defense. The third line of defense is the Internal Audit Service, which provides an objective and independent evaluation of the effectiveness of the risk management system.

The Board of Directors considers reports on the status of critical risks of the Fund and Portfolio Companies, risk management measures, approves risk maps/risk registers, risk appetite for the upcoming period on a quarterly basis. Based on results of a thorough analysis and discussions, decisions are taken to further eliminate risks and improve the corporate risk management system.

All key risks, including the risks of accidents, the risks of significant investment projects, the risks of social instability, financial risks, the litigation risks, the reputation risks, the risk of the impact of sanctions legislation, the privatization program risks were in constant focus of attention and control of the Board of Directors.

Performance Evaluation of the Board of Directors

In 2022, the assessment of corporate governance was carried out, including a self-assessment of the activities of the Board of Directors, by questioning members of the Board of Directors and key structural subdivisions of the Fund in the context of the following five areas:

1) Effectiveness of the Board of Directors and the Management Body;

2) Risk management, internal control and audit;

3) Sustainable development;

4) Rights of the Sole Shareholder;

5) Transparency.

The assessment scope has covered the period from July 01, 2021, to September 30, 2022.

The overall corporate governance rating of the Fund based on the results of the self-assessment has increased as compared to the rating of 2021, which was issued based on the results of the independent assessment of PricewaterhouseCoopers LLP. The increase in the rating was influenced by a significant improvement in measures in such areas as risk management, sustainable development and transparency.

Based on results of the diagnosics, key recommendations were given for further improving the efficiency of corporate governance. As part of these recommendations, the Fund will continue to improve the quality of corporate governance.

Information on the participation of members of the Board of Directors in meetings in 2022

|

№ |

Member of the Board of Directors, position |

Attendance at meetings of the Board of Directors |

|

1. |

Dudas J. - Chairman of the Board of Directors, Independent Director |

83 % |

|

2. |

Suleimenov T.M. - Member of the Board of Directors, First Deputy Head of the Executive Office of the President of the Republic of Kazakhstan |

94 % |

|

3. |

Kuantyrov A.S. - Member of the Board of Directors, Minister of National Economy of the Republic of Kazakhstan |

83 % |

|

4. |

Zhamishev B.B. – Independent Director |

100 % |

|

5. |

Sutera L. - Independent Director |

89 % |

|

6. |

Ong B.H. - Independent Director* |

100 % |

|

7. |

Satkaliyev A.M. - Member of the Board of Directors, Chief Executive Officer of the Fund |

100 % |

*On February 19, 2022, he resigned from the Board of Directors of the Fund

Note: The members of the Board of Directors did not participate in the meetings of the Board of Directors of the Fund for valid reasons.

Committees under the Board of Directors

Decisions of the Board of Directors are taken by a simple majority of votes, after in-depth consideration by the relevant Committees, which devote sufficient time to discuss and analyze each issue.

The Committees promote in-depth and thorough consideration of issues within the competence of the Board of Directors and improve the quality of decisions taken, especially in such areas as audit, risk management, proper and effective application of policies of the Fund, sustainable development, including issues of occupational safety and environmental protection.

Committees are established to perform in-depth analysis and formulate recommendations on the most important matters before they are considered at the meeting of the Board of Directors. The Committees shall not exclude liability of the members of the Board of Directors for the decisions made within its authority. The committee Chairmen prepare the Operating Report of the Committee and report to the Board of Directors on the results of their activities for the year.

Audit Committee

The Committee Role

The Audit Committee is a consulting and advisory body of the Board of Directors of the Fund and was established to assist the Board of Directors of the Fund in performing its control functions over the integrity of financial statements, effectiveness of the internal control and risk management systems, as well as compliance with the principles of corporate governance and legislation. The Audit Committee also makes recommendations to the Board of Directors of the Fund on the appointment or reappointment of an external auditor.

In accordance with requirements of the Corporate Governance Code, the Audit Committee consists exclusively of Independent Directors with in-depth knowledge and practical experience in accounting and auditing, risk management, and internal control.

Changes in the Composition of the Audit Committee

On February 19, 2022, Ong Boon Hwee, Independent Director, resigned from the Board of Directors and the Audit Committee. The Board of Directors of Samruk-Kazyna JSC by decision dated April 08, 2022, No. 195, elected Dudas Jon, Independent Director of Samruk-Kazyna JSC, a member of the Audit Committee.

The Board of Directors of Samruk-Kazyna JSC by decision dated August 25, 2022, No. 200, elected Zhamishev Bolat Bidakhmetovich a member of the Audit Committee.

Work of the Audit Committee for 2022

During the year, the Audit Committee has considered 54 issues of external and internal audit, internal control and risk management systems, financial reporting, corporate governance and compliance. In order to improve the quality of materials, as well as recommendations provided to the Board of Directors of the Fund, the Audit Committee paid special attention to the planning and preparation of meetings to allocate enough time for consideration and discussion of each agenda item, given the number of attending participants.

On External Audit

- Consideration of the selection and appointment process of the audit organization that performs the audit of Samruk-Kazyna JSC for 2022-2024;

- Consideration of the Audit Planning Report of Samruk-Kazyna JSC for 2021;

- Consideration of results of the audit of the consolidated and separate financial statements of Samruk-Kazyna JSC for the year ended December 31, 2021, and conviction of the independence of the auditors;

- Consideration of the results of the limited review procedures of the interim condensed consolidated and separate financial statements of Samruk-Kazyna JSC for the six-month period ended on June 30, 2022;

- Consideration of information on the scope of audit and non-audit services rendered by audit organizations to the Samruk-Kazyna JSC group in 2021, and approval of the publication on the corporate Internet resource of the Fund information on remuneration paid by Samruk-Kazyna JSC to the external auditor for rendering audit and non-audit services for 2021;

- Consideration of issues on approval of rendering consulting non-audit services for Samruk-Kazyna JSC and its Subsidiaries by the audit organization of Samruk-Kazyna JSC.

On Internal Audit

- Consideration of the Annual Audit Plan of the Internal Audit Service, including amendments and additions;

- Consideration of the quarterly audit reports in accordance with the approved Annual Audit Plan, and consideration of reports on unscheduled audits;

- Performance evaluation of the Internal Audit Service employees, as well as assessment of the individual development plans of the Internal Audit Service employees;

- In order to increase the independence of Internal audit and the availability of sufficient resources, the Audit Committee approved the introduction of a separate budget for the Internal Audit Service subject to consideration and approval of the Board of Directors;

- During the year, significant efforts were made to promote value-oriented audits aimed at improving the efficiency of business processes and creating added value.

On Compliance Service

- Consideration of the semi-annual report of the Compliance Service for 2022;

- Consideration and submission of recommendations to the Board of Directors on approval of amendments and additions to the Conflict of Interest Settlement Policy of Samruk-Kazyna JSC;

- Consideration and approval of the appointment of the Compliance Service employees of Samruk-Kazyna JSC based on proposals of the Head of the Compliance Service;

- Consideration of results of a third-party-operated Hotline for anonymous reporting of compliance violations and unethical behavior.

On Internal Control and Risk Management

- Consideration and submission of the consolidated quarterly and annual risk reports of the Fund group for 2021 and 2022 to the Board of Directors;

- Consideration and giving recommendations on the preliminary plan for the development of the second line of defense within the framework of the internal control system of Samruk-Kazyna JSC;

- During the year, the Audit Committee devoted considerable time to discussing risk issues and interacting with risk owners, promoting open and transparent communication, as well as high-quality discussion of key risks.

- Additionally, the Audit Committee provided recommendations on the timing and quality of the preparation of risk reports, on the classification of risks, on their impact on the financial condition of the company, as well as on risk management measures.

On Financial Statements

- Consideration and submission of the Separate and Consolidated Financial Statements of Samruk-Kazyna JSC for the year ended December 31, 2021, to the Board of Directors for approval;

- Consideration of the interim condensed consolidated and separate financial statements of Samruk-Kazyna JSC for m3 and M6 ended on March 30 and June 30, 2022;

- Detailed consideration and discussion with management and the external audit representative of:

- key indicators included in the financial statements, especially those related to the impairment of non-current assets;

- business continuity and liquidity;

- compliance with credit covenants;

- the impact of the January events and sanctions against the Russian Federation on the activities of the Fund group.

- In addition, the Audit Committee provided a recommendation to accelerate the process of automation and digitalization of business processes, as well as financial reporting systems.

On Corporate Governance

- Consideration of the report on compliance/non-compliance with the principles and provisions of the Corporate Governance Code of Samruk-Kazyna JSC, approved by Government Decree of the Republic of Kazakhstan of November 05, 2012, No.1403;

- Consideration and submission of the Annual Report and sustainability report of Samruk-Kazyna JSC for 2021 to the Board of Directors for approval;

- In order to increase confidence to the sustainability report, the investment image and the trust of stakeholders, the Audit Committee recommended considering the possibility of the independent external audit of the sustainability report of Samruk-Kazyna JSC next year.

- Consideration and recommendation to the Board of Directors of Samruk-Kazyna JSC to submit the issue “On Amending Decree of the Government of the Republic of Kazakhstan of November 05, 2012, No.1403, “On Approval of the Corporate Governance Code of Joint Stock Company “Sovereign Wealth Fund “Samruk-Kazyna” for consideration of the Sole Shareholder of Samruk-Kazyna JSC.

- In 2022, the Audit Committee held a total of 18 meetings, including 7 in-presence and 11 absentee meetings. In total, the Audit Committee considered 54 issues in various areas within its competence, of which 74% of the issues were considered at the in-presence meetings and 26% of the issues were considered at the absentee meetings.

- It should be noted that the absentee meetings were devoted to the approval of non-audit services rendered by the external auditor according to the policy of the Fund and in order to ensure the preservation of the independence of the external audit organization.

- In addition, a number of meetings were organized with the participation of the Audit Committee members with the Head of the Internal Audit Service, the Head of the Compliance Service and the management of the Fund beyond the meetings of the Audit Committee to discuss issues of internal and external audit, risk management and internal control, corporate governance and compliance.

Participation of Committee members at meetings in 2022

|

№ |

Member of the Audit Committee |

Position |

Attendance of Committee meetings |

|

1. |

Luca Sutera |

Independent Director, member of the Board of Directors of the Fund, Committee Chairman |

100 % |

|

2. |

Ong Boon Hwee* |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

|

3. |

Jon Dudas |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

|

4. |

Bolat Zhamishev |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

Strategy Committee

The Committee Role

The Board of Directors of the Fund by the decision dated December 13, 2018, established the Strategy Committee, whose competence includes pre-consideration and development of recommendations to the Board of Directors of the Fund on issues affecting the strategic directions of the Fund activities.

Changes in the Composition of the Strategy Committee

The Committee consists of at least three members, one of whom must be an Independent Director. The tenure of Committee members aligns with their tenure as members of the Board of Directors of the Fund.

In the period up to January 06, 2022, Asset Armanovich Irgaliyev, who held the position of Minister of National Economy of the Republic of Kazakhstan, was elected to the position of the Chairman of the Strategy Committee. On January 11, 2022, the President of the Republic of Kazakhstan by the Decree appointed Alibek Kuantyrov to the post of the Minister of National Economy of the Republic of Kazakhstan.

During 2022, the authorities of the following members of the Strategy Committee under the Board of Directors of the Fund were terminated prematurely:

- the Board of Directors of the Fund by decision of February 18, 2022, No. 192, terminated prematurely authorities of Kim Vyacheslav Konstantinovich, the Independent Director, based on his application for early termination of his authorities as the member of the Board of Directors of the Fund with the entry into force of the decision from January 17, 2022;

- the Board of Directors of the Fund by decision of August 25, 2022, No. 200, terminated prematurely authorities of Ong Boon Hwee, the Independent Director, based on his application for early termination of his authorities as the member of the Board of Directors of the Fund with the entry into force of the decision from January 19, 2022.

Due to changing the composition of the Board of Directors of the Fund, Zhamishev Bolat Bidakhmetovich, the Independent Director, was elected as a member of the Strategy Committee according to decision of the Board of Directors of the Fund of

August 25, 2022, No. 200, with entry into force from the date of the decision.

As of December 31, 2022, the Strategy Committee consisted of the following persons:

Kuantyrov Alibek Sakenovich - the Minister of National Economy of the Republic of Kazakhstan - Chairman of the Committee;

Dudas Jon - Independent Director;

Zhamishev Bolat Bidakhmetovich – Independent Director.

Work of the Strategy Committee for 2022

In 2022, 7 in-presence meetings of the Strategy Committee were held.

The Committee meetings were held on a regular basis in accordance with the Work Plan of the Committee for 2022, which in turn included the priority and most important issues of the Committee’s activities for 2022.

The following issues were considered and discussed at the Committee meetings:

- approval of the 10-year strategic plan and the medium-term action plan for the 5-year planning period;

- approval of the forecast of final macroeconomic indicators for use in the Action Plans of the Fund and its Portfolio Companies for the planned period 2023-2027, as well as for 2022-2026 due to the adjustment of the Action Plan for the specified period;

- Monitoring of the medium-term Action Plan;

- Monitoring of major investment projects, as well as the status of implementation of 13 priority projects.

- Approval of the Concept for the Transition to Low-Carbon Development of the Fund, including the Plan for the Fund transition to a low-carbon business model;

- Approval of the Work Plan of the Committee and submission of the annual operating report of the Committee to the Board of Directors.

Participation of Committee members at meetings in 2022

|

№ |

Member of the Strategy Committee |

Position |

Participation in |

|

1. |

Alibek Kuantyrov |

Minister of National Economy of the Republic of Kazakhstan, Member of the Board of Directors of the Fund, Committee Chairman |

100 % |

|

2. |

Jon Dudas |

Independent Director, Chairman of the Board of Directors of the Fund, Committee Member |

100 % |

|

3. |

Bolat Zhamishev |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

Nomination and Remuneration Committee

The Committee Role

The Nomination and Remuneration Committee is responsible for providing recommendations and formulating proposals on the issues of attracting qualified specialists to the Board of Directors, the Management Board, the position of Corporate Secretary, approval of remuneration of independent directors, terms of remuneration and bonus payments paid to members of the Management Board and Corporate Secretary.

The Nomination and Remuneration Committee should comprise a majority of Independent Directors to make objective and independent decisions and prevent the influence of stakeholders on the Committee’s decision-making.

Changes in the composition of the Nomination and Remuneration Committee

In accordance with Decree of the Government of the Republic of Kazakhstan of January 28, 2022, No.34 “On Amendments and Additions to Some Decrees of the Government of the Republic of Kazakhstan and Instructions of the Prime Minister of the Republic of Kazakhstan”, Suleimenov T.M., First Deputy Head of the Executive Office of the President of the Republic of Kazakhstan was elected a member of the Board of Directors of the Fund.

In view of the above-mentioned change in the composition of the Board of Directors of the Fund, the Board of Directors of the Fund by decision of February 18, 2022, No.192, revised the composition of the Nomination and Remuneration Committee, including election of Suleimenov T.M. to the Committee with entering the decision into force from the date of the decision-making by the Sole Shareholder of the Fund on his election as a member of the Board of Directors of the Fund.

As of December 31, 2022, the Committee consisted of the following persons:

- Jon Dudas - an Independent Director -Chairman of the Committee;

- Suleimenov Timur Muratovich – First Deputy Head of the Executive Office of the President of the Republic of Kazakhstan, Committee Member;

- Sutera Luca – Independent Director - Committee Member.

Work of the Nomination and Remuneration Committee for 2022

In 2022, 7 (seven) meetings of the Nomination and Remuneration Committee of the Board of Directors of the Fund were held, of which 4 in-presence and 3 absentee meetings.

The Committee meetings were held on a regular basis according to the Work Plan of the Committee for 2022.

The following issues were considered and discussed at the Committee meetings:

- formation of proposals for the Board of Directors on the election of members of the Management Board;

- consideration of amendments and additions to internal regulatory documents, including those related to the HR Policy, remuneration of management and employees accountable to the Board of Directors;

- consideration of the corporate key performance indicators of the Fund in the form of the Fund KPIs Chart and performance evaluation of members of the Management Board;

- approval of the goals of the Corporate Secretary, the Ombudsman and results of their achievement;

Approval of the Work Plan of the Committee and submission of the annual operating report of the Committee to the Board of Directors.

In 2022, 7 (seven) meetings of the Nomination and Remuneration Committee of the Board of Directors of the Fund were held via videoconference, of which 4 in-presence and 3 absentee meetings. 20 (twenty) issues were considered in accordance with the Work Plan.

Participation of Committee members at meetings in 2022

|

№ |

Transformation Program Oversight Committee members |

Position |

Participation in Committee meetings (%) |

|

1. |

Jon Dudas |

Independent Director, Chairman of the Board of Directors of the Fund, Committee Chairman |

100 % |

|

2. |

Timur Suleimenov |

First Deputy Chief of Staff of the President of the Republic of Kazakhstan, Member of the Board of Directors of the Fund, Committee Member |

71 % |

|

3. |

Bolat Zhamishev |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

Transformation Program Oversight Committee

The Committee Role

The Transformation Program Oversight Committee is a consultative and advisory body of the Board of Directors of Samruk-Kazyna JSC and was established to carry out the task of monitoring and assessing the implementation of the Fund’s Transformation Program, consideration of the assets privatization and restructuring issues and preparing the necessary recommendations to the Board of Directors of the Fund.

Changes in the Committee Composition

In accordance with Decree of the Government of the Republic of Kazakhstan of January 28, 2022, No.34 “On Amendments and Additions to Some Decrees of the Government of the Republic of Kazakhstan and Instructions of the Prime Minister of the Republic of Kazakhstan”, Suleimenov T.M., First Deputy Head of the Executive Office of the President of the Republic of Kazakhstan was elected a member of the Board of Directors of the Fund. The authorities of Bozumbayev K.A., the member of the Board of Directors of the Fund, were prematurely terminated by the specified Decree of the Government of the Republic of Kazakhstan.

In view of the above-mentioned change in the composition of the Board of Directors of the Fund, the Board of Directors of the Fund by decision dated February 18, 2022, No. 192, revised the composition of the Transformation Program Oversight Committee, including:

- the authorities of Bozumbayev K.A., the Committee member, were terminated prematurely with the entry into force of the decision from the date of the decision by the Sole Shareholder of the Fund on the early termination of his authorities as the member of the Board of Directors of the Fund;

- the authorities of Kim V.K., the Committee member - Independent Director, were terminated prematurely based on his application for early termination of his authorities as the member of the Board of Directors of the Fund with the entry into force of the decision dated January 17, 2022;

- Suleimenov T.M. was elected the Committee member with the entry into force of the decision from the date of the decision of the Sole Shareholder of the Fund on his election as the member of the Board of Directors of the Fund.

Due to changing the composition of the Board of Directors of the Fund, Zhamishev Bolat Bidakhmetovich, the Independent Director, was elected as a Committee member according to decision of the Board of Directors of the Fund of August 25, 2022, No. 200, with entry into force from the date of the decision.

As of December 31, 2022, the Oversight Committee consisted of the following persons:

- Jon Dudas - an Independent Director -Chairman of the Committee;

- Suleimenov Timur Muratovich – First Deputy Head of the Executive Office of the President of the Republic of Kazakhstan, Committee Member;

- Zhamishev Bolat Bidakhmetovich – Independent Director, the Committee member.

Work of the Committee for 2022

In 2022, six meetings of the Transformation Program Oversight Committee under the Board of Directors of the Fund were held, of which 3 in-presence and 3 absentee meetings.

The following issues were discussed and considered at the meetings of the Committee in 2022:

- on the realization of the Fund assets, including those related to the IPO of JSC NC KazMunayGas and the determination of the method of transferring up to 100% of the shares of JSC QAZAQ AIR to the competitive environment;

- the Progress Report on Assets Withdrawal of Samruk-Kazyna JSC and its Subsidiaries;

- Amendments and Additions to the Rules for the Transfer to the Competitive Environment of the Assets of Joint Stock Company “Sovereign Wealth Fund “Samruk-Kazyna” and organizations, at least fifty percent of the voting shares (equity interests) of which is directly or indirectly owned by Samruk-Kazyna JSC on the right of property;

- Approval of the Work Plan of the Committee and submission of the annual operating report of the Committee to the Board of Directors.

Participation of Committee members at meetings in 2022

|

№ |

Transformation Program Oversight Committee members |

Position |

Participation in Committee meetings (%) |

|

1. |

Jon Dudas |

Independent Director, Chairman of the Board of Directors of the Fund, Committee Chairman |

100 % |

|

2. |

Timur Suleimenov |

First Deputy Chief of Staff of the President of the Republic of Kazakhstan, Member of the Board of Directors of the Fund, Committee Member |

83 % |

|

4. |

Bolat Zhamishev |

Independent Director, member of the Board of Directors of the Fund, Committee Member |

100 % |

Specialized Committee

The Specialized Committee carries out a comprehensive and objective analysis of the impact of the activities of organizations owned by the Fund Group on the development of the economy or a particular branch of the economy, except for issues related to their use of the funds of the National Fund of the Republic of Kazakhstan, the Republic Budget, as well as guarantees and assets of the state.

Management Board and its Committees

The Management Board is the collegial -executive body of the Fund, which manages its current activities and is ¬responsible for implementing the development strategy and development plan, as well as decisions taken by the Board of Directors and the Sole Shareholder of the Fund. The Management Board of the Fund carries out its activities in accordance with the legislation of the Republic of Kazakhstan, the Charter of the Fund, decisions of the Sole Shareholder and the Board of Directors of the Fund, the Regulations on the Management Board and other internal documents of the Fund.

The Chief Executive Officer is appointed by the decision of the Sole Shareholder. Members of the Management Board are elected by the decision of the Board of Directors of the Fund.

In their activities, the Management Board and the Chief Executive Officer are accountable to the Sole Shareholder and the Board of Directors of the Fund. The competence of the Management Board includes, inter alia, the following:

Taking decisions on issues referred in accordance with the legislation of the Republic of Kazakhstan and (or) the Charter to the competence of the general meeting of shareholders (participants), another body of the company or other legal entity in relation to which the Fund is a shareholder, participant or has the right to a share in the property, except for decisions on issues taken by the Sole Shareholder or the Board of Directors of the Fund in accordance with the Law “On Sovereign Wealth Fund”;

- Taking prompt actions in respect of companies to prevent disruptions in the completeness and deadline of the implementation of investment decisions and investment projects;

- Formation of a unified (including by industry sectors of companies) financial, investment, production and economic, scientific and technical, money management, HR, social and other policies in relation to companies;

- Approval of the rules for the development, approval, adjustment, execution and monitoring of the implementation of companies’ development plans;

- Approval of the staff size, staff schedule and organizational structure of the Fund;

- Hearing on an annual basis the results of the Portfolio Companies activities and reporting on the results of companies’ activities to the Board of Directors of the Fund;

- Taking decisions on issues of the Fund’s internal activities.

The complete list of issues referred to the exclusive competence of the Fund’s Management Board is disclosed in the Charter of the Fund at www.sk.kz.