For investors and stakeholders

Samruk-Kazyna JSC investment activities:

Financial investments

Strategic Investments

Direct Investments

1. Financial investments

Privatization

29

The Comprehensive Privatization Plan for 2021-2025 includes 29 assets of the Samruk-Kazyna JSC Group of Companies

12

assets are executed

12

assets are realized

17

assets are in the process of pre-sale preparation

4

large assets of the Fund are subject to IPO/sale by means of an open two-stage tender

13

assets are subject to transfer to the competitive environment in other ways

IPO / sale by means of an open two-stage competition:

2022 year

2023 year

2024 year

2025 year

Assets

Contacts

| Contact information on the sale and privatization of assets | Company | Phone |

|---|---|---|

| Contacts on privatization of assets of the Samruk-Kazyna JSC Group of Companies | Samruk-Kazyna JSC | +7 (7172) 55-26-80 |

| Contact details of Commissions for the sale of assets of subsidiaries of Samruk-Kazyna JSC | JSC NC KazMunayGas | +7 (7172) 78-92-38 |

| JSC NC Kazakhstan Temir Zholy | +7 (7172) 60-35-00 | |

| Samruk-Kazyna Ondeu LLP | +7 (7172) 73-71-33 | |

| JSC NMC Tau-Ken Samruk | +7 (7172) 55-95-10 |

Contacts on privatization of assets of the Samruk-Kazyna JSC Group of Companies

Куратор: Samruk-Kazyna JSC

+7 (7172) 55-26-26

Contact details of Commissions for the sale of assets of subsidiaries of Samruk-Kazyna JSC

JSC NC KazMunayGas

+7 (7172) 78 92 38

JSC NC Kazakhstan Temir Zholy

+7 (7172) 60 35 00

ТОО «Объединенная химическая компания»

+7 (7172) 73 71 33

JSC NMC Tau-Ken Samruk

+7 (7172) 55 95 10

АО «НАК «Казатомпром»

+7 (7172) 45 83 33 (вн. 10162)

2. Strategic Investments

Projects

Projects for the construction and expansion of the solar power plant

Burnoye in the Zhambyl region

Samruk-Kazyna Invest implements these projects in partnership with UG Energy Limited (UK) based on project companies Burnoye Solar-1 LLP and Burnoye Solar-2 LLP with the 49% share of Samruk-Kazyna Invest. In addition, within the framework of these projects, borrowed financing from EBRD has been attracted.

The first and second stages of the solar power plant were commissioned in 2015 and 2018, respectively.

166,5

m kWh

In 2022, the Burnoye station, generated 154.1 million kWh of electricity against the plan for 155.2 million kWh.

685,79

m kWh

From the date of commissioning to December 31, 2022, the Burnoye station has generated 964.9 million kWh of electricity.

The entire volume of generated electricity is bought by Settlement and Financial Center for Support of Renewable Energy Sources LLP based on the Law of the Republic of Kazakhstan «On Support for Use of Renewable Energy Sources».

The Project Partner:

UG Energy Limited

UG Energy Limited – a subsidiary of United Green (hereinafter – UG), which in turn is an international diversified group that makes direct investments in dynamically developing industries, including projects in the field of renewable energy sources.

UG participates in implementation of projects both as a strategic investorand by providing turnkey project implementation services.

The total peak capacity of the projects implemented by UG in the field of renewable energy is more than 400 MW with a total cost of $1.2 billion, including more than $300 million provided as capital investments.

The UG offices and representative offices are located in London (England), Dubai (UAE), Hamburg (Germany) and Erbil (Iraq).

3. Direct Investments

Investment Projects

According to the mission and Development Strategy of Samruk-Kazyna JSC (hereinafter – the Fund) until 2031, taking into account the challenges and opportunities at the global, national and corporate levels, the key priorities for the Fund are: sustainable development, responsible investments, effective and active portfolio management.

The Fund is particularly interested in attracting investments and technologies for implementation of breakthrough and high-tech projects.

The Fund also strives for carbon neutrality, in accordance with the Message of the Head of State to the People of Kazakhstan of September 1, 2021, which announced new priorities, including achieving carbon neutrality by 2060.

In addition, the Fund is aware of the importance of its impact on the economy, ecology and society, and will ensure that its activities comply with the principles of sustainable development by coordinating its environmental (E), social (S) and governance (G) goals, while maintaining a balance of interests of stakeholders.

At the moment, in conditions of insufficient infrastructural development, the priority of the Fund is infrastructure and “green” investments within the country, including those aimed at development of non-resource sectors.

Фонд в особенности заинтересован в привлечении инвестиций и технологий для реализации прорывных и высокотехнологичных проектов.

Фонд также стремится к углеродной нейтральности, в соответствии с Посланием Главы государства народу Казахстана от 1 сентября 2021 года, в ходе которого были озвучены новые приоритеты, в том числе достижение углеродной нейтральности к 2060 году.

Кроме того, Фонд осознает важность своего влияния на экономику, экологию и общество, и обеспечит соответствие своей деятельности принципам устойчивого развития путем согласованности своих экологических (E), социальных (S) и управленческих (G) целей, соблюдая баланс интересов заинтересованных сторон.

В условиях недостаточности инфраструктурного развития, на сегодняшний день для Фонда наиболее приоритетными являются инфраструктурные и «зеленые» инвестиции внутри страны, направленные в том числе на развитие несырьевых секторов.

Investment branches

Investment mechanisms of cooperation with Samruk-Kazyna JSC

Samruk-Kazyna JSC attracts foreign direct investment to Kazakhstan through mutually beneficial investment structures. In particular, there are two schemes of potential partnership: co-investment in capital and investment through private equity funds with participation of Samruk-Kazyna JSC.

When investing, the Fund adheres to the “Yellow Pages” principle, and promotes sustainable development, including the ESG principles, as well as a ban on investments in tobacco, alcohol, weapons, etc.

The Fund makes direct investments in the equity of projects with total cost above USD 150 million, as well as in individual smaller projects, depending on their scalability.

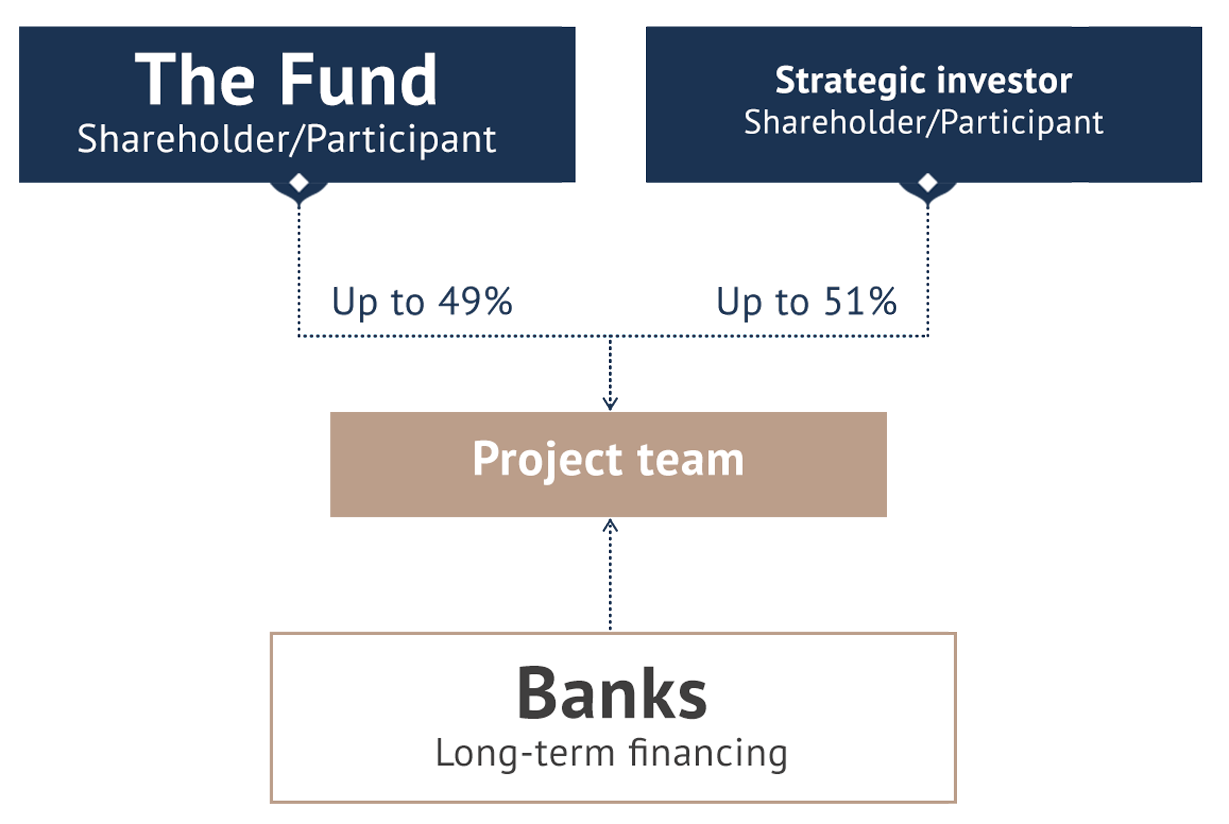

Structure of Participation in the Project

IRR > CoE, NPV > 0

Target capital structure:

The share of the Fund in the project capital is less than 50%

Example of a financing structure:

| Sources | $ million | Share |

|---|---|---|

| Own funds: | 60 | 30% |

| Fund | 29 | 49% |

| Strategic partner | 31 | 51% |

| Borrowed funds | 140 | 70% |

| Total cost | 200 | 100% |

Requirements for a project partner

The project must have a strong financially stable strategic partner who has the necessary experience and technology for joint implementation and financing of the investment project.

The period of the Fund’s participation

Long-term approach (5-7 years or more), depending on the up-side potential.

The Fund’s exit strategy

Exit from the project by selling a stake to a strategic partner, financial investor or through IPO.

Restrictions in choosing investments

- Start-up companies

- Venture financing

- Oil and gas industry, in terms of exploration and production

Contacts

Director of the Investment and Business Support Department

Amir Tussupov, office phone +7 7172 55 2697

Head of the Investment Support Sector

Askhat Kabirov, office phone +7 7172 55 2651

Head of the Investor Relations and Business Support Sector

Laura Demesinova, office phone 8 (7172) 55 40 36

Процесс принятия решения

При принятии решений АО «Самрук-Қазына» руководствуется ответственностью перед нынешним и будущим поколениями Казахстана. Мы придерживаемся строгого поэтапного подхода к каждой инвестиции в соответствии с Корпоративным Стандартом по инвестиционной деятельности.