Инвесторлар мен стейкхолдерлерге

«Самұрық-Қазына» АҚ үш бағытта инвестиция құяды:

Қаржылық инвестициялар

Стратегиялық инвестициялар

Тікелей инвестициялар

1. Қаржылық инвестициялар

Жекешелендіру

29

включено

Жекешелендірудің 2021-2025 жылдарға арналған кешенді жоспарына «Самұрық-Қазына» АҚ компаниялар тобының 29 активі енгізілді.

12

орындалды

12

актив өткізілді

17

сату алдындағы дайындық үстінде

4

ірі активі IPO / ашық екі кезеңді конкурс тәсілімен сатылымға шығарылады

13

актив басқа тәсілдермен бәсекелестік ортаға беріледі

IPO/ ашық екі кезеңді конкурс тәсілімен сату:

2022 жыл

2023 жыл

2024 жыл

2025 жыл

Активтері

Байланыс деректері

| Активтерді сату және жекешелендіру бойынша байланыс деректері | Компанияның атауы | Телефон |

|---|---|---|

| «Самұрық-Қазына» АҚ компаниялар тобының активтерін жекешелендіру бойынша байланыс телефоны | «Самұрық-Қазына» АҚ | +7 (7172) 55-26-80 |

| «Самұрық-Қазына» АҚ еншілес ұйымдарының активтерін сату жөніндегі комиссиямен байланыс | «КазМунайГаз» ҰК» АҚ | +7 (7172) 78-92-38 |

| «Қазақстан темір жолы» ҰҚ» АҚ | +7 (7172) 60-35-00 | |

| «Samruk-Kazyna Ondeu» ЖШС | +7 (7172) 73-71-33 | |

| Тау-Кен Самұрық» ҰТК» АҚ | +7 (7172) 55-95-10 |

«Самұрық-Қазына» АҚ компаниялар тобының активтерін жекешелендіру бойынша байланыс телефоны

Куратор: «Самұрық-Қазына» АҚ

+7 (7172) 55-26-26

«Самұрық-Қазына» АҚ еншілес ұйымдарының активтерін сату жөніндегі комиссиямен байланыс

«КазМунайГаз» ҰК» АҚ

+7 (7172) 78 92 38

«Қазақстан темір жолы» ҰҚ» АҚ

+7 (7172) 60 35 00

«Біріккен химиялық компания» ЖШС

+7 (7172) 73 71 33

Тау-Кен Самұрық» ҰТК» АҚ

+7 (7172) 55 95 10

«Қазатомөнеркәсіп» ҰАК» АҚ

+7 (7172) 45 83 33 (вн. 10162)

2. Стратегиялық инвестициялар

Жобалар

Жамбыл облысындағы «Бурное» күн электр станциясының құрылысы және кеңейту жобалары

Аталған жобалар «Самұрық-Қазына Инвест» UG Energy Limited (Ұлыбритания) компаниясымен серіктестікте «Burnoye Solar-1» ЖШС және «Burnoye Solar-2» ЖШС жобалау компаниялары базасында «Самұрық-Қазына Инвест» қатысу үлесімен 49% іске асырылды. Сондай-ақ, аталған жобалар шеңберінде ЕҚДБ-ның қарыздық қаржыландыруы тартылды.

Күн электр станциясының бірінші және екінші кезектері сәйкесінше 2015 және 2018 жылдары пайдалануға берілді.

166,5

млн кВт*с

2022 жылы «Бурное» станциясы жоспар бойынша 155,2 млн кВт*сағ 154,1 млн кВт * сағ электр энергиясын өндірді.

685,79

млн кВт*с

Пайдалануға берілген сәттен бастап 2022 жылғы 31 желтоқсанға дейін «Бурное» станциясы 964,9 млн кВт*сағ электр энергиясын өндірді.

Өндірілетін электр энергиясының барлық көлемін «Жаңартылатын энергия көздерін пайдалануды қолдау туралы» ҚР Заңы негізінде «Жаңартылатын энергия көздерін қолдау жөніндегі есеп айырысу-қаржы орталығы» ЖШС сатып алады.

Жоба бойынша серіктес:

UG Energy Limited

UG Energy Limited – United Green (бұдан әрі - UG) еншілес ұйымы, ол өз кезегінде қарқынды дамып келе жатқан салаларға, оның ішінде жаңартылатын энергия көздері саласындағы жобаларға тікелей инвестицияларды жүзеге асыратын халықаралық әртараптандырылған топ болып табылады.

UG стратегиялық инвестор ретінде де, «толық аяқтау» жобаларын іске асыру бойынша қызметтер көрсету арқылы да жобаларды іске асыруға қатысады.

ЖЭК саласында UG іске асырған жобалардың жиынтық ең жоғары қуатының жалпы құны 1,2 млрд. АҚШ доллары болатын 400 МВт құрайды, оның ішінде 300 млн. АҚШ капиталға инвестиция ретінде берілген.

UG офистері мен өкілдіктері Лондон (Англия), Дубай (БАӘ), Гамбург (Германия), Эрбил (Ирак) қалаларында орналасқан.

3. Тікелей инвестициялар

Инвестициялық жобалар

Жаһандық, ұлттық және корпоративтік деңгейлердегі сын-қатерлер мен мүмкіндіктерді ескере отырып, «Самұрық-Қазына» АҚ (бұдан әрі – Қор) 2031 жылға дейінгі миссиясы мен даму стратегиясына сәйкес Қор үшін: орнықты даму, жауапты инвестициялар, портфельді тиімді және белсенді басқару негізгі басымдық болып табылады.

Қор, әсіресе, серпінді әрі жоғары технологиялық жобаларды іске асыру үшін инвестициялар мен технологияларды тартуға мүдделі.

Қор Мемлекет басшысының 2021 жылғы 1 қыркүйектегі Қазақстан халқына Жолдауына сәйкес көміртегі бейтараптығына ұмтылады, оның барысында жаңа басымдықтар, оның ішінде 2060 жылға қарай көміртегі бейтараптығына қол жеткізу айтылды.

Сонымен қатар, Қор өзінің экономикаға, экологияға және қоғамға әсер етуінің маңыздылығын түсінеді және мүдделі тараптардың мүдделерінің тепе-теңдігін сақтай отырып, өзінің экологиялық (E), әлеуметтік (S) және басқарушылық (G) мақсаттарын үйлестіру арқылы өз қызметінің орнықты даму қағидаттарына сәйкестігін қамтамасыз етеді.

Инфрақұрылымдық дамудың жеткіліксіздігі жағдайында, бүгінгі таңда Қор үшін ел ішіндегі, оның ішінде шикізаттық емес секторларды дамытуға бағытталған инфрақұрылымдық және «жасыл» инвестициялар басымдық танытады.

Фонд в особенности заинтересован в привлечении инвестиций и технологий для реализации прорывных и высокотехнологичных проектов.

Фонд также стремится к углеродной нейтральности, в соответствии с Посланием Главы государства народу Казахстана от 1 сентября 2021 года, в ходе которого были озвучены новые приоритеты, в том числе достижение углеродной нейтральности к 2060 году.

Кроме того, Фонд осознает важность своего влияния на экономику, экологию и общество, и обеспечит соответствие своей деятельности принципам устойчивого развития путем согласованности своих экологических (E), социальных (S) и управленческих (G) целей, соблюдая баланс интересов заинтересованных сторон.

В условиях недостаточности инфраструктурного развития, на сегодняшний день для Фонда наиболее приоритетными являются инфраструктурные и «зеленые» инвестиции внутри страны, направленные в том числе на развитие несырьевых секторов.

Инвестициялау салалары

«Самұрық-Қазына» АҚ-мен ынтымақтастықтың инвестициялық тетіктері

«Самұрық-Қазына» АҚ өзара тиімді инвестициялық құрылымдар арқылы Қазақстанға тікелей шетелдік инвестицияларды тартуға қатысады. Атап айтқанда, әлеуетті әріптестіктің екі схемасы бар: капиталға бірлескен инвестициялау және «Самұрық-Қазына» АҚ-тың қатысуымен тікелей инвестициялардың қорлары арқылы инвестициялау.

Инвестициялау кезінде Қор «Yellow pages» қағидатын ұстанады, сондай-ақ ESG қағидаттарын, сондай-ақ темекіге, алкогольге, қаруға және т. б. инвестициялауға тыйым салуды қоса алғанда, тұрақты дамуға жәрдемдеседі.

Қор құны 150 миллион АҚШ долларынан басталатын жобалардың акционерлік капиталына, сондай-ақ олардың ауқымдылығына байланысты жекелеген кішігірім жобаларға тікелей инвестицияларды жүзеге асырады.

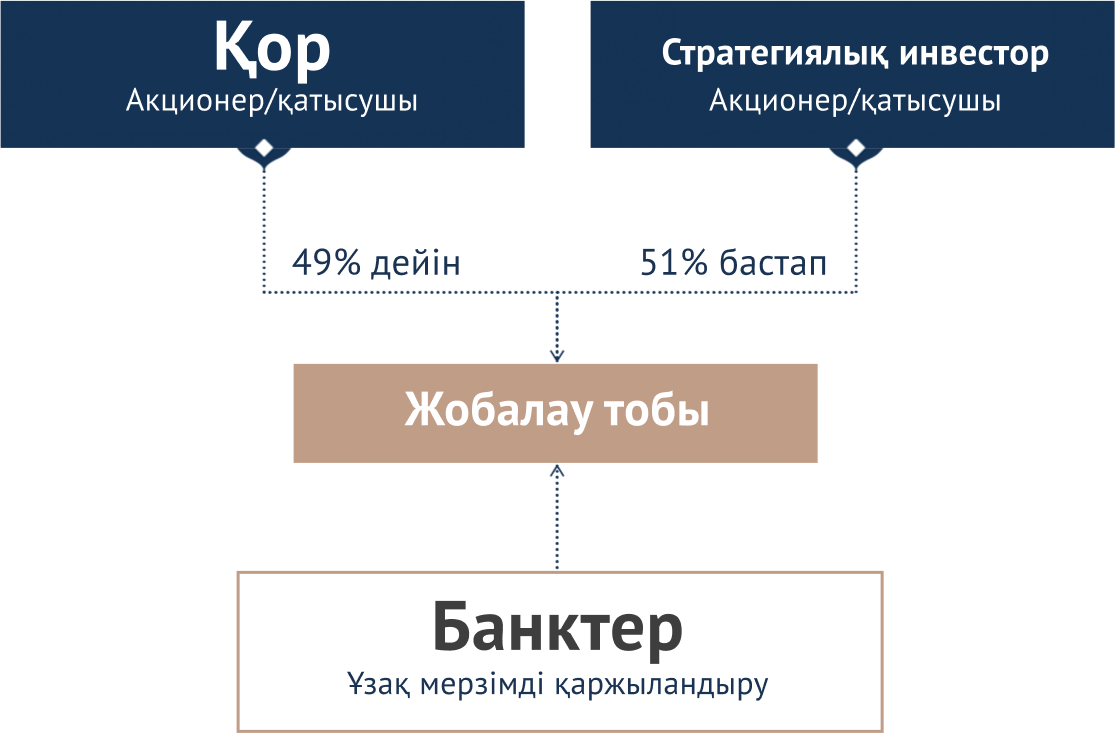

Жобаға қатысу құрылымы

IRR > CoE, NPV > 0

Капиталдың мақсатты құрылымы

Жоба капиталындағы Қордың үлесі кемінде 50%

Жобаны қаржыландыру құрылымының мысалы:

| Дереккөздер | $ млн | Үлесі |

|---|---|---|

| Меншік қаражат: | 60 | 30% |

| Қор | 29 | 49% |

| Стратегиялық серіктес | 31 | 51% |

| Қарыз қаражаты | 140 | 70% |

| Жалпы құны | 200 | 100% |

Жоба бойынша серіктеске қойылатын талаптар

Жобада инвестициялық жобаны бірлесіп іске асыру және қаржыландыру үшін қажетті тәжірибесі мен технологиялары бар мықты қаржылық-тұрақты стратегиялық серіктес болуы тиіс.

Қордың қатысу кезеңі

Ұзақ мерзімді тәсіл (5-7 жыл немесе одан да көп), құнның өсу әлеуетіне байланысты.

Қордың шығу стратегиясы

Үлесті стратегиялық серіктеске, қаржылық инвесторға немесе IPO-ға сату арқылы жобадан шығу.

Инвестицияларды таңдау кезіндегі шектеулер

- Компанияның стартапы

- Венчурлық қаржыландыру

- Барлау және өндіру бөлігінде мұнай-газ саласы

Байланыс

Инвестициялар және бизнесті қолдау департаментінің директоры

Түсіпов Әмір Мерболатұлы , жұмыс нөмірі +7 7172 55 2697

Инвестициялық қызметті сүйемелдеу жөніндегі сектор басшысы

Кабиров Асхат Ахатұлы, жұмыс нөмірі +7 7172 55 2651

Инвестициялық қызметті сүйемелдеу секторының басшысы

Демесінова Лаура, жұмыс нөмірі 8 (7172) 55 40 36

Шешім қабылдау процесі

«Самұрық-Қазына» АҚ шешім қабылдау кезінде Қазақстанның қазіргі және болашақ ұрпақтары алдындағы жауапкершілікті басшылыққа алады. Біз инвестициялық қызметтің Корпоративтік Стандартына сәйкес әр инвестицияға қатаң кезең-кезеңдік тәсілді ұстанамыз.